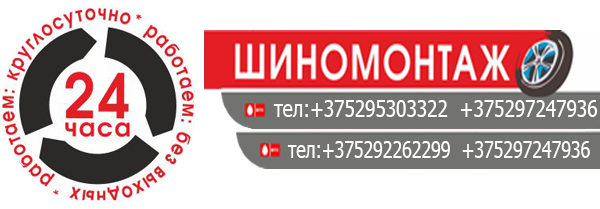

- Мы любим нашу работу! ЧП «МонтажОптима» - Шиномонтаж в Бресте

- +375295303322;

- +375297247936;

Cost Of Payday Loan — The Gender Chart?

Editors’ Choice Award: Kenzy Vixen of «Boston in addition to Single female» Writes really About the woman Dating Trials & Triumphs

25.09.2022When will it be okay for Intercourse with men for the First Time?

26.09.2022To get the money, all you need to do is rush to the closest ATM and withdraw funds. Many people, a few time time or another, will run into an emergency where cash is needed fast. Short-term loans are small loans between $100-$1500.

Do you need cash quick? Are you going through a financial bind? Well there are may different solutions out there for you. You can cut some other costs around the house to be able to get some cash. You could always sell something around the house that you haven’t been using lately too. If you don’t get too embarrassed you could get a loan from a family or friend.

Cash advance payday loans are very aptly named because they provide the borrower with a cash amount that must be paid back every payday until the debt is settled. Usually the amount offered is $1,500 or $3,000. The loans are through special payday loans companies with an exact system that needs to be followed. The quickest way to get cash advance payday loans is online. You must be able to prove you have a regular income, be at least eighteen years old and have an active banking account. Fill in an online application, and if you fit the criteria, you will have your money within twenty-four hours.

Once all your debts are repaid, you are only indebted to this one agency. They will provide you with a much lower interest rate and give you enough time to repay this amount. You can go for either an unsecured debt consolidation or a secured debt consolidation.

The most important advantage of payday loan is that it is available with no fax whereby, there is no documentation or faxing and other tedious paperwork required to get a payday loan.

However, many short-term loan companies, payday loan in escondido loans, cash advance companies, do not pull a credit report. So let’s look at near me loans and how it relates to payday loan in escondido. You establish credit with them usually with a $100 to $500 loan at first. Subsequent loans are generally higher if you’ve paid your loan off in full and on-time.

Fast money. These loans can bring you the much-needed cash almost immediately. In usual circumstances, you can easily get the cash directly credited into your checking account the same day, inside only a few hours.

One thing about same day payday loans is there will be interest fees that you have to pay. These fees will vary from lender to lender. You will end up seeing one lender that wants $40 dollars of every hundred that you borrow. While another lender will only want you to pay $20 dollars of every hundred that you borrow. All interest fees are paid back at the same time the loan is due. If you can not pay it all back at the same time, you can get an extension.

The business of making payday loans has been around for many years, and business appears to very good judging by the amount of new centers opening up. The payday loan does fill a niche in the credit market for people who need short-term loans to get through difficult times but do not qualify for bank loans. The interest rate is high, but may be better off than paying NSF charges that your bank will issue. The term is short, so you need to be sure you can pay it off in that short time. People who can’t pay it back and who have to keep extending the loan get in financial trouble quickly. Since loan companies have figured out loopholes in the legal system, they are operating legally. Now you now some information about payday loans, and they can be useful as long as you are aware of the stipulations.