- Мы любим нашу работу! ЧП «МонтажОптима» - Шиномонтаж в Бресте

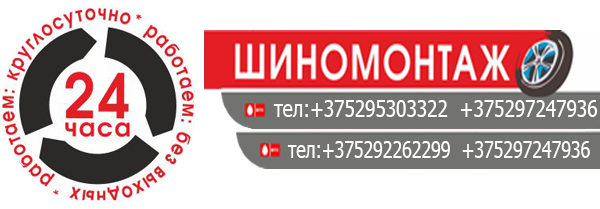

- +375295303322;

- +375297247936;

Bitcoin & Cryptocurrency Exchange & Trading

Best Places To Buy Bitcoin Of 2020

21.04.2022Mining Calculator Bitcoin, Ethereum, Litecoin, Dash and Monero

26.07.2022Содержание

This function is designed to track the current state of traders, wallets, transactions, and content. The automatic check system detects unusual user actions and notifies the administrators about them. The admin panel may include KYC/AML modules and reporting/analytical tools necessary https://xcritical.com/ to comply with the legal procedures of the crypto exchange. It controls the funds in user accounts, creates charts, matches offers and rates, processes real-time prices and commissions, etc. Therefore, developing an engine for a crypto exchange is one of the most challenging tasks.

Similarly, let’s imagine a stop price to sell Bitcoin is set at $50,000. For example, a stop price to buy Bitcoin is set at $60,000, which is the price that will trigger the order. If the trader believes the price might increase, they can set a maximum limit price of $60,100, which will be the top price the asset will be bought at. A stop-limit buy can help traders control the price they pay once they’ve established the maximum acceptable price. A crypto market order automatically matches the best available limit order in the order book, removing liquidity from it. Therefore, it’s considered a taker order, and it’s the reason why exchanges usually charge market orders a higher fee.

Bitcoin is a general-purpose cryptocurrency and is a main pioneer in the industry. It operates using blockchain, which allows Bitcoin to digitally exchange anonymous, heavily encrypted hash codes across a peer-to-peer network. It was created by Satoshi Nakamoto, whose real name has never been revealed. Most modern currency is often referred to as «fiat» currency, which is regulated and produced by a government entity. In contrast, cryptocurrency is not issued by any government authority.

Most exchanges charge a fee to withdraw bitcoin, other cryptocurrencies, and local currencies. The withdrawal fees charged by exchanges tend to change frequently, often without notice. Liquidity refers to the ease with which you can trade in and out of an asset — and it depends largely on the number of buyers and sellers there are for an asset. Cash is typically considered the most liquid asset, as it’s almost universally accepted.

How Do Cryptocurrencies Work?

Cryptocurrency exchanges are also where individuals convert a given type of cryptocurrency into cash or a fiat currency. Most cryptocurrencies are created via a process commonly referred to as cryptomining. With cryptomining, high-powered GPU systems are used to decrypt the cryptographic hash to create a new block. Each type of cryptocurrency has a finite number of blocks that can be mined. Over time, it becomes increasingly more complex and difficult to mine coins from an established cryptocurrency. For example, in 2010, a regular user with a GPU-powered system might have been able to mine Bitcoin.

Kim Kardashian’s SEC fine: Why she has to pay for posting a weird crypto ad. — Slate

Kim Kardashian’s SEC fine: Why she has to pay for posting a weird crypto ad..

Posted: Mon, 03 Oct 2022 20:52:00 GMT [source]

You can also sign up for email updates on the SEC open data program, including best practices that make it more efficient to download data, and SEC.gov enhancements that may impact scripted downloading processes. Please declare your traffic by updating your user agent to include company specific information. IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc.

For example, third parties can operate such exchanges to give users more control over their funds. Orders and transactions are encrypted, fixed in time, and stored in blockchain, while order approvals are performed outside blockchain on a third-party node. A cryptocurrency is an encrypted data string that denotes a unit of currency. It is monitored and organized by a peer-to-peer network called a blockchain, which also serves as a secure ledger of transactions, e.g., buying, selling, and transferring. Unlike physical money, cryptocurrencies are decentralized, which means they are not issued by governments or other financial institutions.

The IRS also published Frequently Asked Questions on Virtual Currency Transactionsfor individuals who hold cryptocurrency as a capital asset and are not engaged in the trade or business of selling cryptocurrency. Pips are the units used to measure movement in the price of a cryptocurrency, and refer to a one-digit movement in the price at a specific level. Generally, valuable cryptocurrencies are traded at the ‘dollar´ level, so a move from a price of $190.00 to $191.00, for example, would mean that the cryptocurrency has moved a single pip. However, some lower-value cryptocurrencies are traded at different scales, where a pip can be a cent or even a fraction of a cent.

Ways To Invest In Cryptocurrency At Schwab

Cryptocurrency futures are leveraged products, meaning you could lose more than you initially invested. Access to conventional investment accounts can usually be recovered if your credentials are misplaced. Several mutual fund and ETF products invest in Bitcoin futures contracts, providing clients with a brokerage account a way to get indirect exposure. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns.

This method of powering a blockchain network is known as «proof of stake,» and the owner of the crypto can earn a type of dividend by staking their holdings, which are usually paid in additional coins or tokens. Buy and sell orders are aggregated into an ‘order book’ which is maintained by the exchange for the purpose of efficiently and automatically matching buyers and sellers. Most exchanges allow you to set both ‘market buy’ orders and ‘limit buy’ orders. When you create a market buy order, you only need to indicate how much bitcoin you’d like to buy (you don’t set the price). The exchange will automatically match you with the seller currently offering the lowest price, and execute your trade. Market orders are, by and large, instantly completed, meaning the moment you submit the order, you’ll receive your bitcoin in your exchange wallet/account.

A stop-limit sell order helps traders define the minimum price they are willing to accept from a buyer. If the entire order isn’t completed, the remaining balance is then placed as an open order at the price of $49,500. A stop order is significantly different from a limit order because it includes a stop price meant only to trigger an actual order when the set price has been reached. Moreover, the market can see a limit order, while a stop order can’t be seen until triggered.

Cryptocurrency Examples

In October 2019, the SEC filed a complaint against Telegram alleging that the company had raised $1.7 billion through the sale of 2.9 billion GRAMS (the company’s native cryptocurrency) to finance its business. GRAMS were to allow customers of the messaging service to use the token as a means of payment for goods and services within the Telegram ecosystem. The SEC sought to enjoin Telegram from delivering the GRAMS it sold, which, using the Howey Test, the regulator alleged were securities and were not properly registered. District Court for the Southern District of New York issued a preliminary injunction. Ultimately, Telegram abandoned its plan to issue the GRAMS tokens, and agreed to repay the $1.2 billion to investors and pay an $18.5 million civil penalty.

Read our expert Q&A about what you should know before investing in crypto. Blockchain is a digital public ledger where information on each transaction receives a unique «hash» and is added to the end of the ledger. Bitcoin’s success has put blockchain on the map and put its potential to decentralize and improve the digital economy on a path to disrupting the status quo. However, a licensee under the West Virginia Fintech Regulatory Sandbox does not need to apply for a separate money transmitter license.W. See also theDepartment of Financial Services’ page on virtual currency.

These are all cryptocurrency exchanges — digital marketplaces where you can buy and trade crypto. The site’s price is determined after a meticulous study of your terms for cryptocurrency exchange platform development and the thorough calculation of all types of work. When developing an online cryptocurrency exchanger, we will find effective solutions for you, create a stylish design, and think through convenient site navigation. Besides, you can modify your platform by adding or removing some features. The choice of the cryptocurrency exchange platform tech stack generally depends on the type of your product and the devices it’s developed for. Anyway, it’s always better to choose a robust and future-proof technology so that your platform will be scalable and powerful.

Bitcoin

Make sure to download the software from the company’s official website. Anyone using Google Chrome, Microsoft Edge, Mozilla Firefox or Brave browsers can download the wallet as an extension. You can also download the MetaMask app on your mobile Android or Apple devices. Money’s Top Picks Best Credit Cards Cash back or travel rewards, we have a credit card that’s right for you.

In 2020, in coordination with crypto exchanges, Colombia introduced a sandbox test environment for cryptocurrencies in order to help firms try out their business models in respect of draft legislation. The FIU also delisted all privacy coins from South Korean exchanges in 2021 . A number of crypto startups admit that the centralized model of crypto-exchanges was a necessary first step to develop the market, but that the next evolution will come from decentralized exchanges. While this type of venue currently represents trivial volumes, it is gaining significant attention and might represent the next evolution and/or addition in the cryptocurrency exchange landscape.

These wallets can be software that is a cloud-based service or is stored on your computer or on your mobile device. The wallets are the tool through which you store your encryption keys that confirm your identity and link to your cryptocurrency. Like brokerage firms, some crypto exchanges offer trading alternatives, such as limit orders.

Taxpayers transacting in virtual currency may have to report those transactions on their tax returns. By using this site, you are agreeing to security monitoring and auditing. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority.

What Is Cryptocurrency: Types, Benefits, History And More

Low-cost currency transfers allow easy transactions between any two currencies, which some organizations find attractive as a resilient mechanism for commerce. Cryptocurrency is a digital form of currency that uses cryptography to secure the processes involved in generating units, conducting transactions and verifying the exchange of currency ownership. Stop limit orders are particularly effective in cryptocurrency markets because they help control the high volatility that characterizes them, thereby assisting the trader in mitigating risks. A limit price defines the highest price traders are willing to pay to buy the cryptocurrency or the lowest they are eager to pay in case of a sale. A crypto limit order is an instruction to buy or sell a cryptocurrency only at a price specified by the trader. It is best suited for the trader who can patiently wait for a price target to be reached.

- For example, if someone paints your house, you could potentially negotiate to send the person an agreed amount of bitcoin as payment.

- Peter Palion, a certified financial planner in East Norwich, New York, thinks it’s safer to stick to a currency backed by a government, like the U.S. dollar.

- These crypto-focused banks can act in both a custodial and fiduciary capacity and are meant to allow businesses to hold digital assets safely and legally.

- At the same time, our business analysts did their best to build an effective marketing and branding strategy for future users’ onboarding.

- Users of decentralized exchanges must remember the keys and passwords to their crypto wallets, or their assets are lost forever and cannot be recovered.

They are mainly used by traders for speculating on rises and falls in value. Cryptocurrency trading is the act of speculating on cryptocurrency price movements via a CFD trading account, or buying and selling the underlying coins via an exchange. Blockchain is the technology that enables the existence of cryptocurrency . Bitcoin is the name of the best-known cryptocurrency, the one for which blockchain technology was invented.

Latest News On Crypto Wallets

As such, citizens should be able to use Bitcoin to pay taxes and other government services. In the early days of Bitcoin, many hoped that the cryptocurrency could and would be used to buy everyday items, such as a pizza. In 2010, Laszlo Hanyecz bought $41 worth pizza from Papa John’s, for which he paid 10,000 bitcoin at the time. In 2021, that amount of bitcoin would have been worth over $380 million. The change from PoW to PoS occurred in an event known as «The Merge.» Activities on the legacy Ethereum Mainnet blockchain, which used PoW, were merged with the newer Beacon chain, which uses PoS.

These are online brokers who offer ways to buy and sell cryptocurrency, as well as other financial assets like stocks, bonds, and ETFs. These platforms tend to offer lower trading costs but fewer crypto features. A decentralized, distributed ledger monitors all cryptocurrency transactions around the world. In the case of the popular cryptocurrency Bitcoin, the distributed ledger is what is known as a blockchain, which is a digital system that keeps track of cryptographic hash blocks. An online trading platform that is used to buy, sell and exchange cryptocurrencies. Exchanges convert fiat currency (dollars, Euros, etc.) to crypto (Bitcoin, Ethereum, etc.), and vice versa.

What Is The Safest Crypto Wallet?

Curious new crypto investors need to start by making decisions about how to invest, including how to store their digital assets. Investors will need to evaluate where and how to transact in cryptocurrencies, and whether staking tokens—a way of earning rewards or interest for holding certain cryptocurrencies—is worth it. That means deciding to trade on a crypto exchange, How to create a cryptocurrency exchange and learning how you will use it. Users of decentralized exchanges must remember the keys and passwords to their crypto wallets, or their assets are lost forever and cannot be recovered. They require the user to learn and get familiar with the platform and the process, unlike centralized exchanges, which offer a more convenient and user-friendly process.

If you are a beginner in the crypto market, we recommend sticking to Coinbase Wallet, our best crypto wallet for beginners, or Trust Wallet, our best crypto wallet for mobile. Cryptocurrencies are also speculative assets, which are riskier due to large fluctuations in price. Many active traders invest in them with the hope of making a big profit after their value dramatically increases in the near future — hopefully before a crash. The idea of a decentralized currency independent of the banking industry is enticing for many. The wild price swings can be a thrill, and some coins are simply amusing.