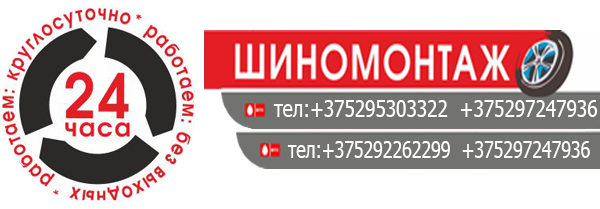

- Мы любим нашу работу! ЧП «МонтажОптима» - Шиномонтаж в Бресте

- +375295303322;

- +375297247936;

Top Stocks For July 2020

Обзоры и сравнение торговых счетов Fxpro

15.12.2021The top three schools of general

17.01.2022

Arbitrage Trading

This is necessary in areas similar to insurance coverage, which should be in the name of the company and not the primary shareholder. The largest shareholders (in terms of percentages of corporations owned) are often mutual funds, and, especially, passively managed trade https://1investing.in/stocks/-traded funds. The earliest acknowledged joint-inventory company in trendy times was the English (later British) East India Company, one of the most notorious joint-stock corporations. It was granted an English Royal Charter by Elizabeth I on December 31, 1600, with the intention of favouring trade privileges in India.

A inventory spinoff is any monetary instrument for which the underlying asset is the price of an equity. Futures and options are the principle kinds of derivatives on stocks. The underlying safety may be a inventory index or a person agency’s stock, e.g. single-inventory futures.

These are the shares with the bottom 12-month trailing worth-to-earnings (P/E) ratio. These high-rated equity funds could be stable anchors for traders’ U.S. publicity. These prime-rated funds could https://cex.io/ be solid anchors for investors’ abroad publicity. For traders of all stripes, we provide our best ideas on tips on how to take control of your portfolio in turbulent times.

Is it good to buy stock?

That, combined with a history of strong performance, is enough to have many investors wondering how to buy Nike stock. The good news: Compared to other big-name growth stocks, Nike is fairly reasonably priced, currently hovering around $90 per share.

Tesla inventory, Amazon inventory and Netflix stock had been huge early winners. The Nasdaq pared gains as a top Fed official said «we might want to get again to more unaided market operate» by decreasing central bank intervention, though he stressed that time isn’t now. But the actual selling got here after California reimposed many coronavirus lockdown orders and Los Angeles said colleges will not reopen within the fall, big blows to economic restoration hopes. If you are younger and saving for a protracted-time period goal corresponding to retirement, you may need to maintain extra shares than bonds. Investors nearing or in retirement could need to maintain extra bonds than stocks.

What are good small stocks to buy right now?

You should sell that stock, even if it means incurring a loss. The key to successful investing is to rely on your data and analysis instead of Mr. Market’s emotional mood swings. If that analysis was flawed for any reason, sell the stock and move on.

Likewise, many large U.S. firms listing their shares at foreign exchanges to lift capital overseas. If an organization goes broke and has to default on loans, the shareholders aren’t liable in any means. Although ownership of fifty% of shares does result in 50% possession of an organization https://1investing.in/, it does not give the shareholder the right to use a company’s building, tools, materials, or other property. This is as a result of the corporate is considered a authorized person, thus it owns all its assets itself.

However, regardless of these positives, shares have but to rebound to previous price levels ($1532.11 per share). In other phrases, the inventory looks fairly low-cost contemplating its development prospects.

There are most likely more funding scams out there than there are positive issues. Whether it is your broker, your brother-in-legislation or a late-night time infomercial, take the time to be sure that someone isn’t utilizing you to double their cash. It won’t double in a yr, nevertheless it ought to, ultimately, given the old rule of 72. The rule of 72 is a famous shortcut for calculating how long it will take for an funding to double if its growth compounds. The result is the number of years it’s going to take to double your money.

- Small cap shares are listed corporations which have market capitalizations usually ranging from $300 million to $2 billion.

- Since the share prices of these corporations can have big fluctuations over a brief period of time, corporations with market caps of as much as $10 billion are additionally discovered within the small cap universe.

- Both mutual funds and ETFs can be purchased in quite a lot of methods, however the cheapest, simplest way is both through the ETF or fund issuer itself, or one of many big-name discount on-line buying and selling platforms.

- In different words, the sensible money’s most likely on investing broadly out there and letting the rising tide carry your investment boat.

- But, naturally, there’ll at all times be gamblers energized by a “go huge or go house” mentality.

- The rising public realization of this fact has lead to a massive rush to the exits from lively to passive investments.

The coronavirus inventory market rally began off robust and ended with livid selling. The Dow Jones Industrial Average eked out a tiny acquire in Monday’s inventory market trading, helped by Pfizer inventory and JPMorgan inventory. The Nasdaq composite, which had run as much as one more all-time high intraday, fell 2.1%. The coronavirus stock market rally started off powerfully, fueled by Covid-19 vaccine hopes.

The Royal Charter effectively gave the newly created Honourable East India Company (HEIC) a 15-year monopoly on all trade in the East Indies. The firm reworked from a commercial buying and selling enterprise to one that virtually ruled India because https://www.beaxy.com/ it acquired auxiliary governmental and army features, until its dissolution. Around 1250 in France at Toulouse, 100 shares of the Société des Moulins du Bazacle, or Bazacle Milling Company have been traded at a price that depended on the profitability of the mills the society owned.

Broadly, investing to double your money may be carried out safely over a number of years, or quickly, although there’s more of a threat of losing most or all your money for these that are impatient. There are 5 key ways to double your cash, which can embody utilizing a diversified portfolio or investing in speculative assets. Get Started Learn how one can make more money with IBD’s investing tools, high-performing stock lists, and educational content material.

Morningstar’s Guide To Market Volatility

How can I double my money?

Being able to trade stocks for a living successfully involves reaching a level of excellence. Investing in the stock market is an excellent way to make money off of your initial investment, especially in today’s economic climate where long-term banknotes and savings accounts do not offer significant returns.

Here’s the recipe that one of the best buyers uses to pick stocks. Many massive non-U.S corporations choose to record on a U.S. trade in addition to an exchange of their residence country in order to broaden their investor base. These corporations Stocks should preserve a block of shares at a financial institution in the US, typically a sure share of their capital. On this basis, the holding financial institution establishes American depositary shares and issues an American depositary receipt (ADR) for each share a trader acquires.

New equity problem may have specific legal clauses connected that differentiate them from previous problems with the issuer. Some shares of frequent inventory may be issued with out the typical voting rights, as an example, or some shares could have particular rights unique to them and issued solely Stocks to certain events. Often, new points that haven’t been registered with a securities governing body may be restricted from resale for sure intervals of time. Be prepared to turn extra bullish or bearish as conditions warrant. ReadThe Big Pictureevery day to remain in sync with the market path and leading stocks and sectors.

Granted, shares stay expensive, even after the inventory dipped from past highs. They sometimes provide excessive dividend yields, in addition https://www.binance.com/ to earnings stability. But for low-volatility returns, they could be a great car to invest your money.

Dow Jones Futures Today

Among thebest ETFs, the Innovator IBD 50 ETF (FFTY) skidded three.eight%. The iShares Expanded Tech-Software Sector ETF (IGV) retreated four.three%, as software program stocks showed some promoting even when the market was at intraday highs. The Analog Devices (ADI) takeover deal for Maxim Integrated (MXIM) helped buoy chip names.