- Мы любим нашу работу! ЧП «МонтажОптима» - Шиномонтаж в Бресте

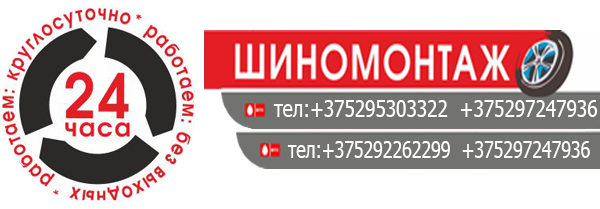

- +375295303322;

- +375297247936;

Cost of Goods Manufactured COGM Formula, Calculation

Привет, мир!

12.10.2020Content

As a reminder, COGS is it’s the amount of money a company spends on labor, materials, and certain overhead costs relating to producing cost of goods manufactured formula a product or service. Once each part of the COGM is calculated, the final amount is placed into the finished goods inventory.

- These costs include direct materials, direct labor, and manufacturing overhead of the products that are transferred from the manufacturing department to the finished goods inventory.

- Cost of goods manufactured considers the costs of producing your product.

- Costs incurred by businesses to manufacture their goods are called production costs.

- If we enter those inputs into our WIP formula, we arrive at $44 million as the cost of goods manufactured .

- At the end of the period, the finished product’s costs are presented in the finished product inventory.

- If the two amounts don’t match, you will need to submit an explanation on your tax form for the difference.

- That means they’re short-term assets meant to generate revenue within the next 12 months.

If you are an eCommerce business looking for a way to unlock significant data-driven growth, then you should consider https://www.bookstime.com/ using REVEAL. This software program can organically increase the number of customers loyal to your business.

Cost of goods manufactured (COGM) vs. total manufacturing cost (TMC)

In production, costs are luckily suitable to calculate in mathematical ways. COGM is an important aspect of every manufacturing company’s financial statements and there are several reasons for this. In simple words, COGM is the total cost of all the inputs that go into making a product. The inputs can be direct or indirect, but they all contribute to the final cost of the product. Finished goods inventory is reported on the restaurant balance sheet as a current asset. That means they’re short-term assets meant to generate revenue within the next 12 months. All three of these are used in the finished goods inventory formula.

It’s been moved out of its initial warehousing environment and is now a work in progress. The process and form for calculating the cost of goods sold and including it on your business tax return are different for different types of businesses. Further, this statement will also serve as the basis for the comparison of operations of manufacturing on a year-to-year basis. Hence, the cost of goods manufactured will be 13,66,47,400 and per unit, it will be 1,366,474 when divide it by 100. At the end of the quarter, $11,000 worth of furniture was still in the production process.

Company

A retail operation has no cost of goods manufactured, since it only sells goods produced by others. Thus, its cost of goods sold is comprised of merchandise that it is reselling. Stay updated on the latest products and services anytime, anywhere. When a company produces its products, you need to have a solid system for calculating COGM. Since you already have the beginning inventory, subtract that amount from the total sales for the period to get your ending inventory. Goods manufactured is a term used for the cost of the inventory that is produced during a period.

- The process and form for calculating the cost of goods sold and including it on your business tax return are different for different types of businesses.

- All three of these are used in the finished goods inventory formula.

- Manufacturing overhead is a part of the COGM formula; more specifically one of the components in the total manufacturing cost part.

- A simple formula to calculate the cost of goods sold is to start with your beginning inventory value, add any purchases or other costs, and subtract your ending inventory value.

- That’s because it’s one of the costs of doing business and generating revenue.

- In addition, it gives actual expenses related to manufacturing and helps manage inventory.

To calculate direct labor, you have to calculate the direct hourly labor rate and the direct labor hours. Knowing how to calculate the COGS of your business is a crucial part of your business. When you subtract the COGS from the revenue, you get the gross profit of your business. Since calculating the profit of your business is the most important part, understanding COGC is very important. For example, there are direct labor expenses and direct materials costs.

Cost of Goods Manufactured vs. Cost of Goods Sold

This means that companies sometimes spend slightly more or less money on production than was expected. However, this knowledge can be used to budget better in the future to understand the causes of these differences and aim to reduce costs. You can calculate the direct material costs by taking the beginning raw materials inventory, adding the cost of the raw materials purchased, and subtracting the ending raw materials inventory.

List all costs, including cost of labor, cost of materials and supplies, and other costs. For example, let’s say your company has 10,000 products for the last month, with 4,000 products only partially completed. The Finished Goods Inventory consists of goods or services that have been totally completed and are ready to be sold to customers. The cost of goods manufactured includes all direct labor incurred during the reporting period. This amount is easily calculated by compiling the payroll cost of all production workers during the reporting period.

COGS Finished Goods Inventory

In addition to this, COGM contributes to the overall clarity and planning of a company. It allows the company to plan and modify the pricing strategy for its products. It gives an accurate comparison of manufacturing operations from year to year.

- The manufacturing overhead cost is the cost of the indirect materials, indirect labor, and other manufacturing costs.

- Cost of Goods Manufactured is a term used in managerial accounting that refers to a schedule or statement that shows the total production costs for a company during a specific period of time.

- If you are selling multiple products, you might want to discontinue products with high COGS.

- Still, heating/air conditioning bills can be trickier because sometimes businesses use their generators instead of paying someone else for heat/cooling services.

- Of course, you can use COG alongside other industry-approved techniques to ensure that you effectively compete with other businesses in the same niche.

- This is usually based on the average price of all the current products in stock.

Recognizing that revenue requires recognizing the COGS—because COGS considers the materials and labor costs applied to each unit sold. You must keep track of the cost of each shipment or the total manufacturing cost of each product you add to inventory. For the items you make, you will need the help of your tax professional to determine the cost to add to inventory.

What does the cost of goods sold mean?

Operating expenses the expenses that aren’t directly tied to creating the product. The latest goods, i.e., the last goods to be added to your inventory, must be first sold.

How to Calculate Cost of Goods Sold (COGS) — Yahoo Finance

How to Calculate Cost of Goods Sold (COGS).

Posted: Mon, 03 Aug 2020 07:00:00 GMT [source]

Making sense of COGM and having efficient systems to measure and track them is key to your survival as a manufacturing business. Depreciation of machines — This cost can vary widely depending on how long your company has been in business and what kind of equipment you have.